The idea of an end-of-year reflection might seem clichéd. But it's often the only time you get to clear your head and consider the aspects of your business that usually just tick along. Thinking about what worked well and what goals you met will get you off to a positive start next year. And celebrating is an essential part of this process.

But this is the time to be honest about when things weren't up to scratch too. Focusing on where you can improve is the best way to arm your business for growth.

So get ready to take on the roaring (20-)20s with confidence: here's our essential guide to what to consider and what questions to ask in your year-end business review.

Did you get real value from your data?

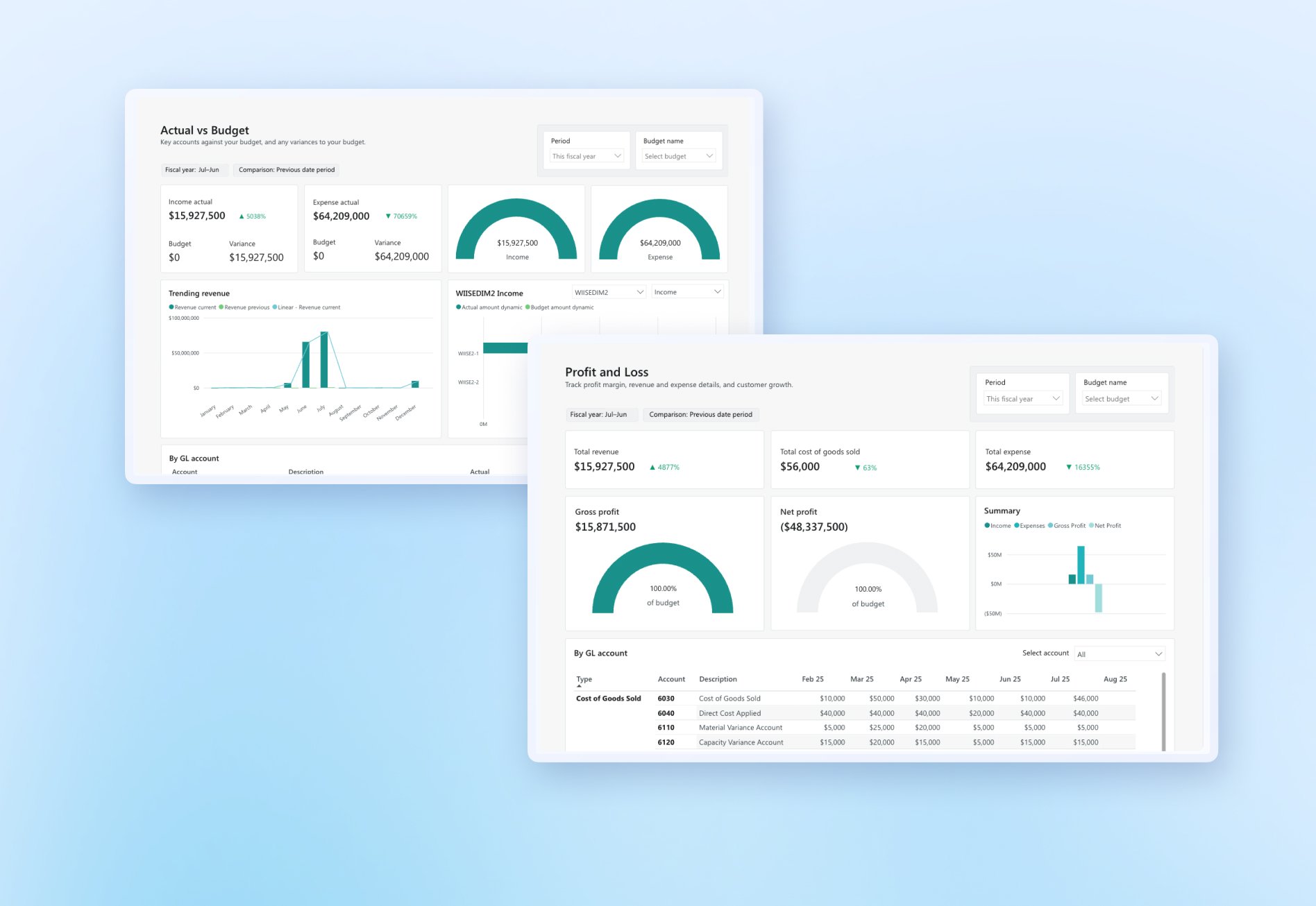

Data was a hot topic in 2019. Yet Microsoft recently released a statistic that said: "73% of business data is unanalysed".* Getting great business insights is essential; from understanding your customers' buying habits through to getting clarity over your business processes. At the very least, data analysis will help you see how your business works at every level, and guide your decision-making. But reliable reporting can also keep shareholders, the board and governing bodies happy. And your accountant, of course. Did you get the most from your data?

Ask yourself: are you capturing the right data, in the right way, and in the right system? What data analysis are you doing to get value from your data? How are you using your data to help you make good business decisions? And are you able to get data out of your business in an instant? Are you getting enough detail from reporting?

Consider whether your business systems give you enough insights to understand the impact of your decisions. Real-time analytics will help you make decisions with confidence. And a reliable cash flow forecast will help you see exactly how much money you can expect to have left in the bank. When you can forecast accurately, and get a clear picture of your inventory, you can make decisions quickly and plan for next year.

Think about whether your reporting suits your growing business's needs and if it can keep up with your complexity. Perhaps you have multiple locations or entities, warehouse stock to manage, or need to tag and track transactions. Take the time to really understand the value that you could be getting from your data and reporting. And think about the return on investment – no one ever regretted improving their business clarity.

Our logistics customer Capital Transport needed to transform how they captured and reported on their data, so they turned to Wiise. By spending less time producing reports, their finance team is now freed up to dive into the data. They're using those insights to improve and grow their business.

Do your systems allow you to scale?

No matter the size of your business, basic tools and siloed systems can make it impossible to manage your growing complexity.

Ask yourself: Is your business growing as you hoped? Or are you running in place? Maybe your systems are holding you back. It's vital that you plan what steps you can take to support your growth. Do you have older systems that need a lot of maintenance, or manual upgrades? That's going to hold you back. And take your focus away from scaling.

Are you getting the full picture of how your business works? Are your accounting, inventory, customer management and operations in one hub? Or are you juggling lots of systems and struggling to keep tabs on everything? Do you feel like you have the right information when you need it to power up your forecasting and make smart decisions to move the business forward?

Consider how consolidated systems would smooth the way to business growth. Imagine how great it would be to have accurate, timely information at your fingertips, without having to wait days and days to get an update across your business with, technically, outdated data from the month before. No matter where you are – you can access everything about your business on the go.

Perhaps collaboration is the thing that was missing – if your team can't work well together because your systems aren't integrated, you'll be missing out. Think about how well you're arming yourselves for the future and if your systems are up to the task.

Are you on top of your cash flow?

It makes sense that the less time you spend worrying about cash flow, the more time you can spend managing your business. Your finance needs are personal – you need to make sure you have a tool that's flexible and fits your business's needs. According to Business Insider, 82% of small businesses fail because they don't have a handle on their cash flow.

Ask yourself: Did you overspend in 2019? How can you better keep track of your finances? Do you have a clear picture of what payments you owe vendors and your payment history? Are you across the depreciation, disposal and maintenance of your fixed assets? Are you happy with your accounts receivable and accounts payable?

Consider what you could achieve with an organised and streamlined chart of accounts with excellent reporting. One that could manage your cost centres and capture the right details about your customers, vendors and items or service.

Think about how well you were able to track your sales process from quote to invoice. Perhaps EFT and integrated banking options would help you get paid faster. So think about what you're missing and what would be on your integrated banking wish list.

Are you getting the best from your people?

As part of your review, you're going to look at your business operations and how you can tweak and improve efficiencies. Or sales. Or your customer base. But as SME owners know, getting things right starts with the people in your business.

Focus on the value each team member is adding to the business and ask yourself: Are you getting the best out of each person? How are you showing your staff that you're investing in them? Apart from professional development?

Consider whether your people are using their skills in roles that give them job satisfaction. Putting people in meaningful jobs, as opposed to just data input or tedious manual jobs, will naturally mean they're more productive. Reducing a heavy admin burden is one way you can do this. If you have multiple team members manually entering data, or spending days on financial reporting, it's inefficient and is no fun for anyone.

Keeping your employees happy is a top priority. In an ideal world, your people feel valued and therefore passionate about what they do. Because that's when they do it well.

There is a better way. Our customer Pro Seafoods has already seen the benefits that streamlining their processes with Wiise has had on their people. They've been able to cut back on two full-time admin roles and move these team members into positions that will help grow the business. They've saved a heap of admin time, given their team members the opportunity to try new things, and also got more time back to build their business for the future.

You're not alone

Wiise is a scaling business too. We know it's tough out there. We work hard every day to help Australian businesses achieve more by getting better insights from their data, taking away their admin burden and letting them get back to doing what they do best. We'll be looking at what we can improve next year so we can continue to offer you a better way to do business. We're also going to take our own advice and do a little bit of celebrating.

Download your free business review checklist here

Let us know what you come up with

What were your challenges in 2019? What will you do better? What's on your 2020 business wish list? If you feel it's time for a better way to do business, give us a call on 1300 191 222.