Wiise Payroll users rejoice, because soon you'll have a lot less admin on your plate. The ATO deadline for Single Touch Payroll (STP) Phase 2 is Tuesday, 1 March 2022, and we're excited to share that Wiise Payroll users will be fully compliant from Day 1.

What’s changing in Phase 2

The new reporting requirements are designed to streamline employer and employee interactions with other government agencies and reduce the admin associated with the hiring and termination of employees.

The key changes to STP Phase 2 reporting include:

Employee payments will be grouped into income type, payment type and country codes as part of the updated income stream collection.

Components of gross earnings (such as paid leave) will need to be reported using itemised tax codes.

What it means for employees

The new allowance codes will make it easier for employees when they are completing individual tax returns.

What it means for employers

- Employers won't have to report child support deductions and garnishees separately.

- Employers won't need to submit employment separation certificates to Service Australia.

- Employers won't need to provide lump sum e-letters to employees when they make a lump sum e payment.

- Employers won't need to submit TFN declarations of new employees to the ATO.

- Employees will have the option to submit negative YTD (year to date) amounts via Single Touch Payroll.

- Wiise Payroll users and compliance

Our platform will be Phase 2 compliant from 28 February 2022, which means Wiise Payroll users won't have to worry. We do recommend reviewing your pay and leave categories, as well as the employment details and tax statuses of your employees in Australia and overseas.

Businesses that do not comply with the new reporting requirements may be liable for fines after 2022, so do your due diligence.

To learn more about STP Phase 2 and what it means for your business, check out this helpful article.

Manage your payroll better with Wiise.

Wiise cloud ERP is built on a globally trusted platform that's been customised for Australian businesses. That's how you can get features like Single Touch Payroll, right out of the box. Here's why our Payroll users swear by Wiise:- Automated awards

- ATO compliance made easy

- Fully integrated timesheets

- Employee self service

- Stress-free, visual rostering

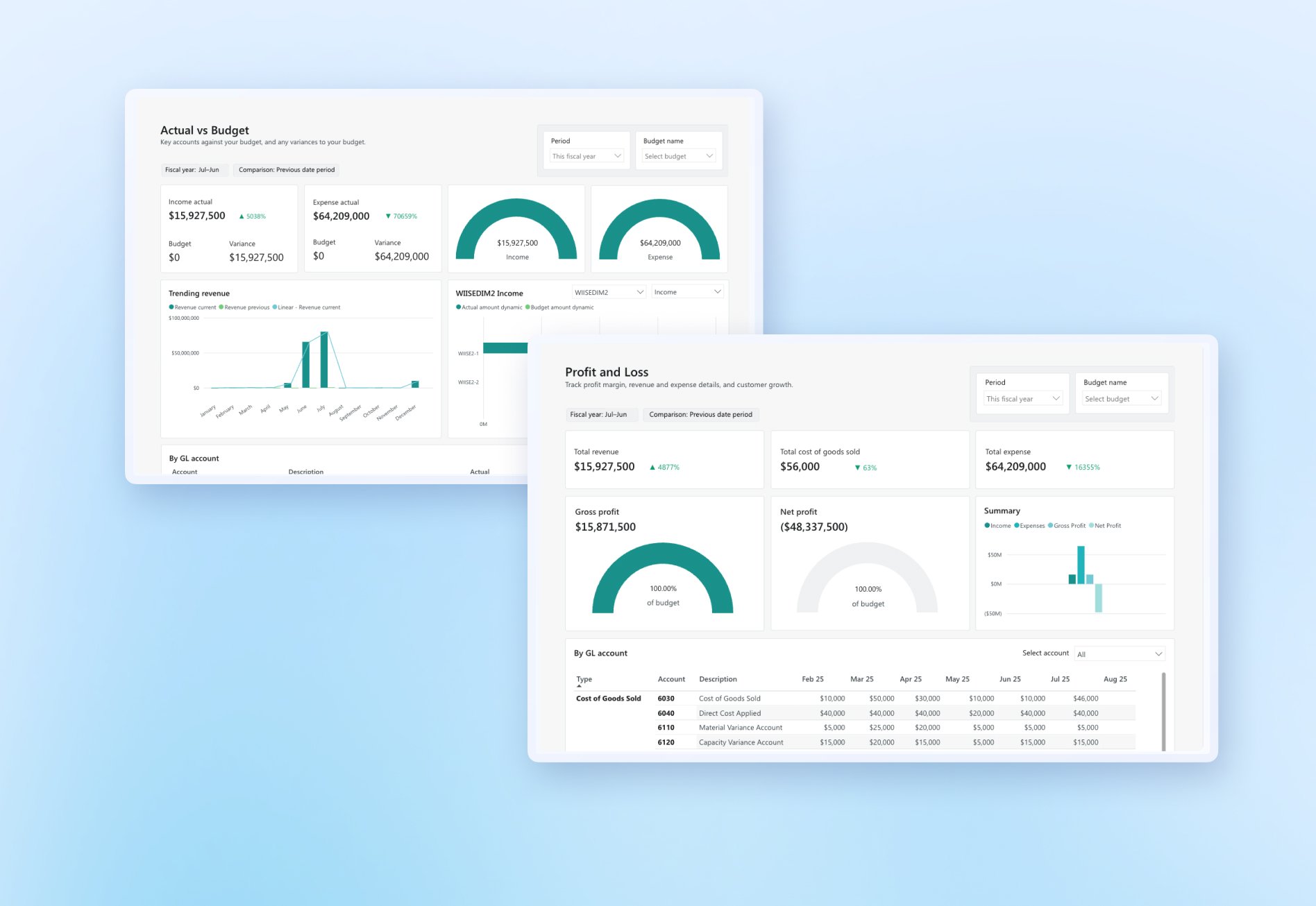

But that's not all, our customers use Wiise to manage their entire business, from accounting to warehousing to projects and job costing. You can too.

Head to our website to learn more about us. If you want to talk to someone about what Wiise can do for your business, get in touch with our team.