What the Federal Budget means for Australian businesses

On Tuesday, 29 March 2022, Treasurer Josh Frydenberg handed down the 2022 Federal Budget. A complete summary of the Budget and its implications for the Australian economy, business, and industries by KPMG can be found here.

This Budget aims to invest in growth, digitisation, and upskilling the labour force of the future. This means that there has never been a better time for organisations looking to manage business processes on cloud technologies.

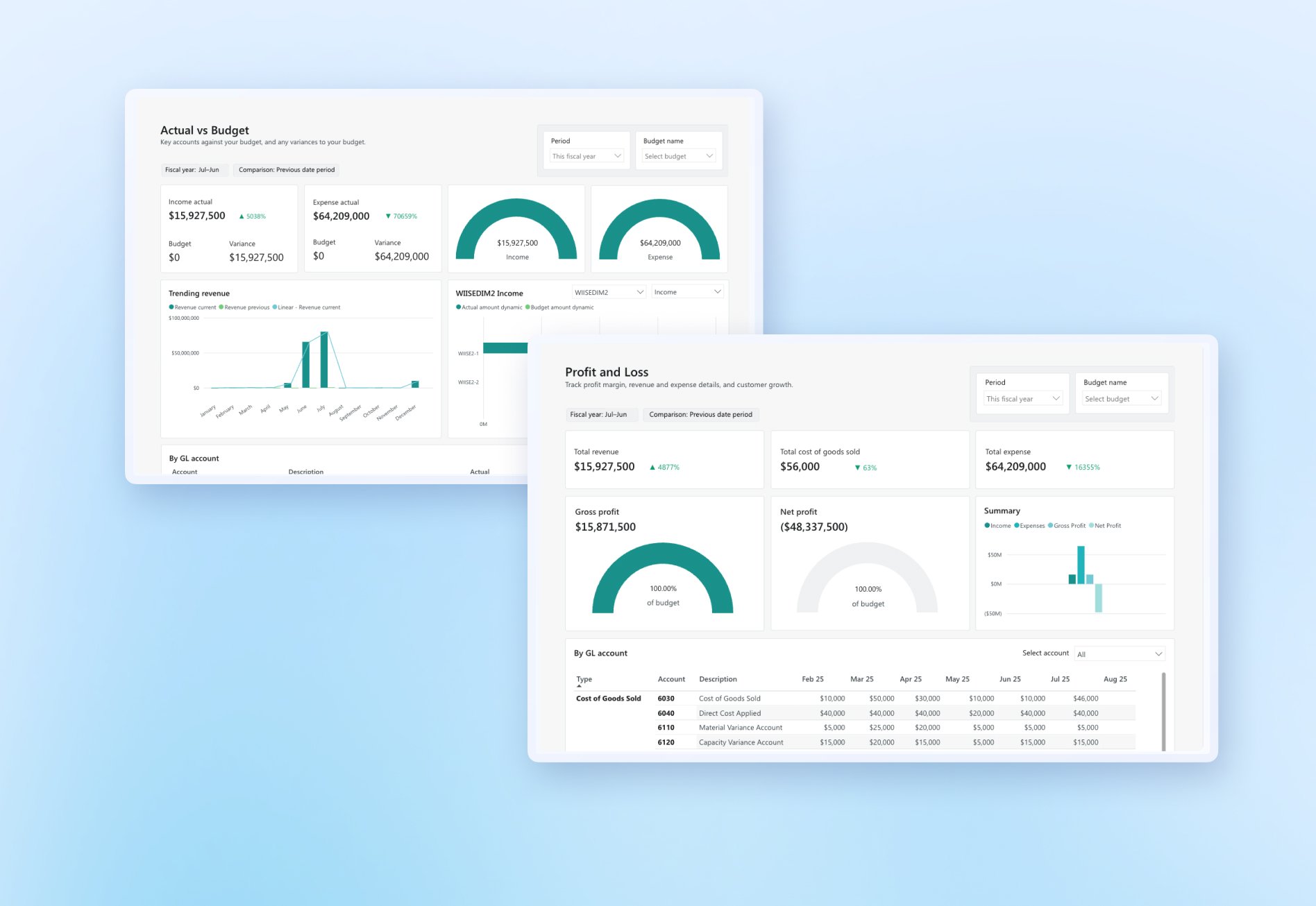

The 2022-23 Budget is focused on helping businesses build resilience by funding their digital transformation. As part of the Technology Investment Boost, small and medium-sized Australian businesses will be able to claim a bonus 20% for the cost of expenses and depreciating assets that support their digital adoption of cloud-based services, including cloud-based subscriptions.

The boost will apply to eligible expenditure incurred from Budget night until 30 June 2023, with an annual cap of $100,000. To be eligible for this incentive, you must:

- Be a registered business with an ABN

- Have an annual revenue $50 million or less

- Only use the bonus for eligible expenditures such as portable payment devices, cyber security systems and subscriptions to cloud-based services like Wiise ERP

“[This is] an encouraging budget for the mid-market sector, Australia's engine room, with no new taxes but targeted measures aimed at innovation and growth and skills training for Australia's workforce.”

Clive Bird National Tax Leader, KPMG Australia

Save on Wiise ERP today

If you've been looking to switch to cloud ERP, now's the time. Speak to our team about our affordable packages today. Book in a time here.