In business, cutting waste is good. Cutting strategic investments, not so good. Inflation in Australia is at its highest since 1990.1 In the last three months, 57% of businesses across the country have seen increased costs2 – a trend set to continue into 2024. But, with many businesses avoiding passing these costs onto customers, the temptation can be to turn to cost-cutting measures to bridge the gap. Cost-cutting rarely ends well – particularly for growing businesses (even Gartner agrees)3 – and can be fraught with long-term risks, including restricting growth, impacting company culture and exposure to cyber-attacks.

Taking the strategic view

In our recent post, Investing in a Downturn: Why ERP is Critical in Recession Intervention, we explored the ways in which prioritising digital technology investment – specifically in an enterprise resource planning (ERP) platform – can build resilience and help your organisation to thrive in a downturn.

In this post, we explore one of the key themes of that post – improving business efficiency (eliminating waste) – and how ERP solutions like Wiise are designed to help you achieve this.

10 Ways to Cut Waste and Improve Efficiency with an ERP

1. Make smarter buying decisions

Wiise purchase requisitions are simple and enable managers to regain control over incidental staff purchases. But ‘incidental’ purchases add up – especially when not monitored. From stationery to special tooling parts, approvers can categorise and view all internal purchases in one place – making it easy to spot unnecessary spend and opportunities to bulk-buy or switch to cheaper suppliers.

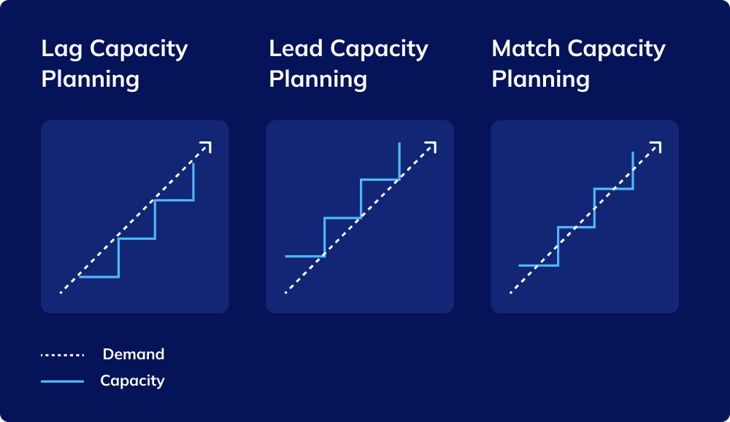

2. Limit your dead stock

Dead stock, obsolete or excess inventory; however you refer to it, stock that isn’t selling is a huge risk for inventory-based businesses. (Allegedly, even well-run businesses can average up to 20% of excess stock in their warehouses4). Wiise inventory management helps you to limit the chances of accumulating excess stock, with automated triggers that tell your teams exactly which products, and how many, to re-order. Cyclic stocktakes ensure that you always keep track of your inventory and can search its location however you choose – by zone, row or bin location.

3. Never run out of your bestsellers

At the other end of the scale, running out of in-demand stock is another major lost opportunity. Wiise inventory management can leverage Microsoft Azure AI to predict which products will run out and when, based on forecast sales and current inventory purchases. Your staff can easily look up the default supplier for an item that’s likely to run out and automatically generate a purchase order for the quantity required and the required landing date.

4. See what your imported stock actually costs

Fully customised for the Australian market, Wiise enables your teams to see the true landed cost of any imported items. Through a combination of Microsoft Azure AI and always-current local retail pricing, transportation costs, duties and taxes, Wiise can provide accurate costing advice from suppliers to help your business calculate how much to charge on top.

5. Reduce your IT overheads with the cloud

Wiise is a cloud-based ERP, eliminating the usual associated costs of on-premise IT workloads (such as servers, storage and networking to the cloud). Not only can cloud-based solutions cut your IT hardware costs, they also provide faster performance (helping your teams to get jobs completed quickly) and full business continuity assurance – keeping your business accessible 24/7.

6. Save on your Microsoft subscription fees

If your business is already using leading-edge Microsoft tools, Wiise ERP is the perfect fit for your business. A Wiise licence gives you access discounts on some Microsoft products, and natively integrates to most Microsoft products, turbo-charging your end-to-end business processes.

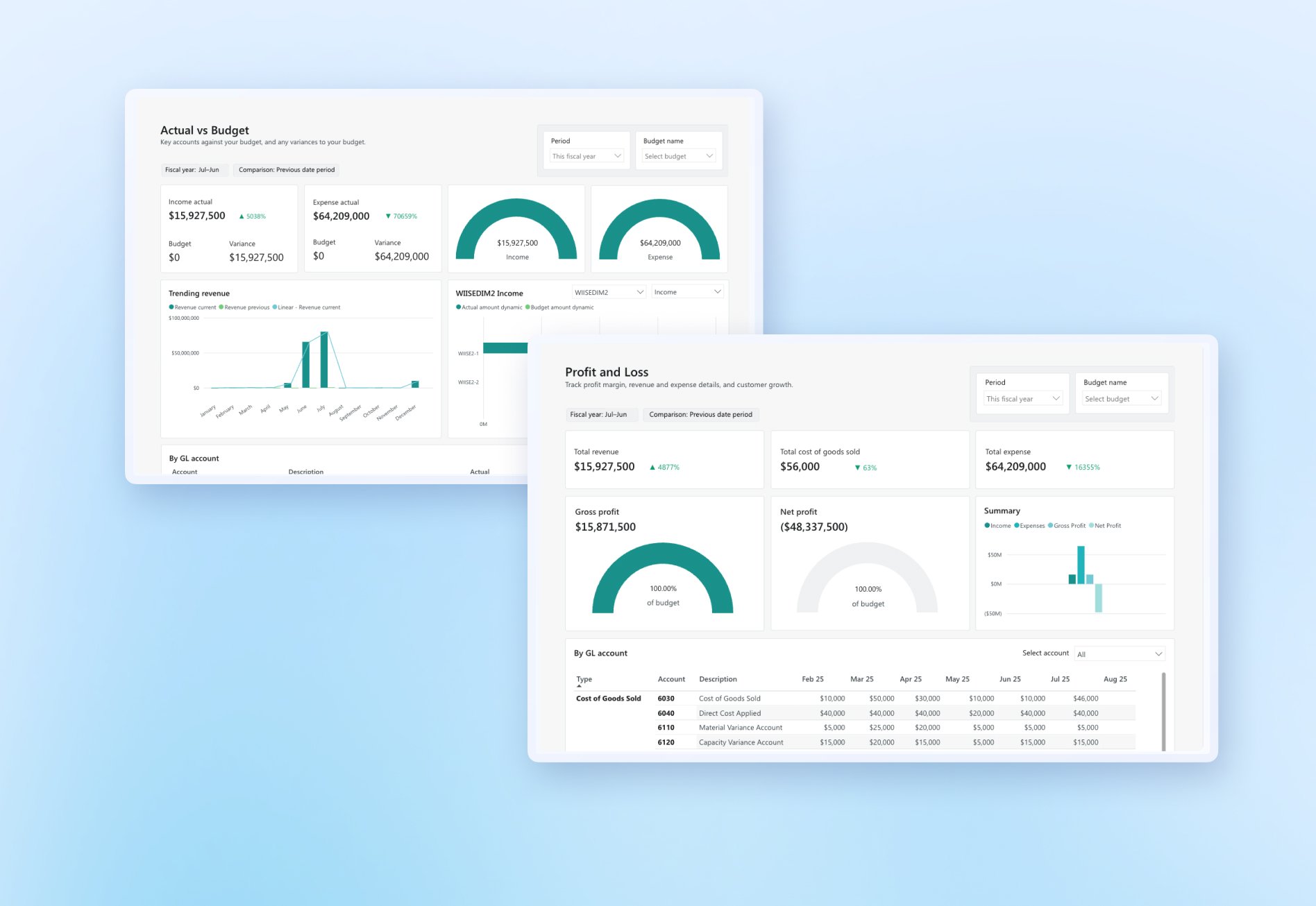

7. Cut down on time-wasting activities

Wiise ERP provides a centralised repository for all key business information, eliminating the need for manual data entry, duplication and time-consuming reporting tasks. A recent example is Wiise customer, FVS: by combining Microsoft Power BI and Wiise AI-powered analytics, the FVS finance team sped up its board reporting by five days a month.

8. Spend less time chasing payments

It’s unpleasant and time-consuming (up to five hours a month, for 22% of Australian businesses5) – but for many finance teams, chasing payments is an unavoidable task. With Wiise reporting, your teams will be able to see all debtor information at a glance, enabling them to pass on payment issues to account managers early, increasing the chances of collection. Even better, with Wiise AI predictions, your teams will be able to see which customers are likely to pay late in future and work to proactively limit chasing.

9. Reduce fraud

Another unpleasant reality of business is fraud. Misappropriation of assets (when employees steal or misuse company resources) is the most common form of occupational fraud, often taking place for up to 12 months before it’s identified.6 Wiise purchase requisitions enable approvers to spot unusual purchases quickly, enabling your managers to address fraudulent activity early and minimise damage to your business.

10. Become paperless (but really paperless)

With self-service payroll and HR that employees can access via their mobile devices, Wiise really does remove receipts, timesheets, leave forms and all those other paper documents that your business has struggled to phase out. Once information is uploaded to Wiise, it becomes a single source of truth, reflected across your entire reporting and business ecosystem – no more duplicate data or more miscalculations.

Is your business still wading through sluggish, small business processes?

Get in touch today to find out how to cut waste and boost efficiency, with Wiise ERP.

1 Forbes (2022), Australian Inflation Rate: RBA Boss Defends Rash Of Rate Hikes.

2 Inside Small Business (2022), Rising living costs put additional pressure on struggling businesses.

3 Gartner (2022), 7 Cost-Reduction Mistakes to Avoid.

4 Manufacturing.net (2017), What Is The Real Cost Of Dead Inventory?

5 Inside Small Business (2021), Late payments remain a major headache for small businesses and sole traders.

6 ACFE (2022), Occupational Fraud 2022.

Ready to learn more?

Book a demo call with one of our friendly team members.