The Australian Taxation Office (ATO) has deferred its initial STP Phase 2 rollout date from 1 January 2022 to 28 February 2022. This means that Wiise Payroll users will only be required to adhere to the new reporting requirements from 1 March 2022 onwards.

What’s new to STP Phase 2

The additional reporting requirements in Phase 2 were included to streamline the interactions between businesses and government agencies. The key changes to Phase 2 reporting can be grouped into the following groups:

- Components of gross earnings will need to be itemised separately

- Additional requirements around employment and taxation conditions

- Additional requirements around income types and country codes

- The ability to report child support deductions and garnishees in pay events

The new reporting requirements will also mean that businesses will no longer have to provide lump sum e-letters or employment termination letters to employees.

Learn more about the changes coming to STP Phase 2 and what you should be doing to prepare in this helpful article.

Review your payroll details now

To ensure your business is fully compliant, we recommend reviewing your pay and leave categories as well as the employment details and tax statuses of your employees, both in Australia and overseas.

Businesses that do not comply with the new reporting requirements may be liable for fines after 2022.

Wiise Payroll has got you covered

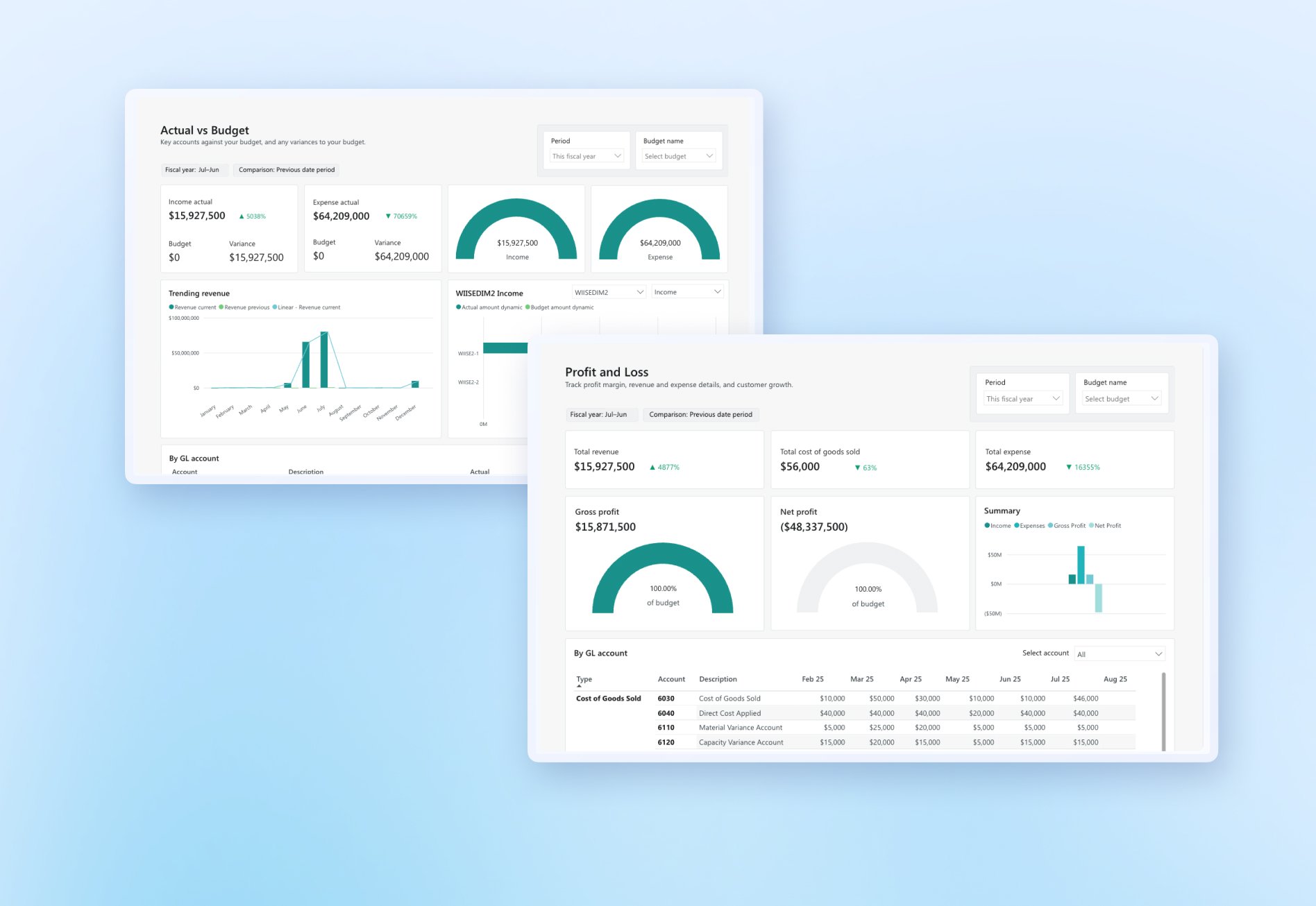

One of the many advantages of choosing Wiise, a cloud ERP built on a globally trusted platform, is that it’s customised for the Australian market—including Single Touch Payroll that’s fully integrated.

By 28 February 2022, Wiise Payroll will be updated to include new features and categories, so our customers can stay compliant with Phase 2 reporting requirements from day one. Wiise Payroll is Fair Work compliant and makes it easy for businesses to keep up with changes to Awards and super payments. In other words, we've got you covered.

Learn more about Wiise Payroll here.