Part 4/4

Here's some food for thought. On paper, finance and operations teams co-own the procure-to-pay process, which spans the sourcing of goods and services and paying for them, and the quote-to-cash process, which encompasses the chain of activities that ensures that payment for the goods and services delivered is collected. Yet, of the 1,300 leaders surveyed, less than one-third said these were viewed as joint responsibilities across the two teams.

The survey also found that there was a fundamental disagreement over who was ultimately responsible for key business processes such as integrated business planning.

- When finance leaders were asked who was ultimately responsible for integrated business planning, 41% said that Finance was ultimately responsible and only 14% said Operations.

- In contrast, when operations leaders were asked the same question, 32% of operations leaders said Operations was ultimately in charge of the process, and only 18% said Finance.

In other words, both sets of leaders think that the responsibility for integrated business planning sat with their respective teams.

To make matters worse, just 40% of finance and operations leaders were very satisfied with their ability to compare and combine data across multiple business functions to draw deeper insights. And only 41% said they were very satisfied with the ability of the IT systems of separate functions to interact.

This is because growing businesses often rely on a number of standalone systems to manage business processes such as inventory planning, purchase orders, logistics, and financial management. And more often than not, there is limited or no integration between these systems. This can lead to a number of complications for every team, which, in the real world, may look like any of the below:

- A resource-strapped finance team that ends up spending a lot of of their time reconciling data from these systems.

- An unhappy customer who was promised an inaccurate delivery date without factoring in the updated estimated shipping time.

- A C-level executive who might be making decisions about entering a new, high-growth market based on half-baked data.

Given these findings, the report notes that alignment between finance and operations teams needs to go beyond just data-sharing and extend to the objectives and KPIs of the two teams.

In the chapter aptly titled 'The Rewards of Connecting', the report explains that close collaboration between finance, operations, sales, and marketing is essential to integrated business planning. In other words, connecting people, processes and data across the organisation is the first step to more accurate and integrated financial and operational planning.

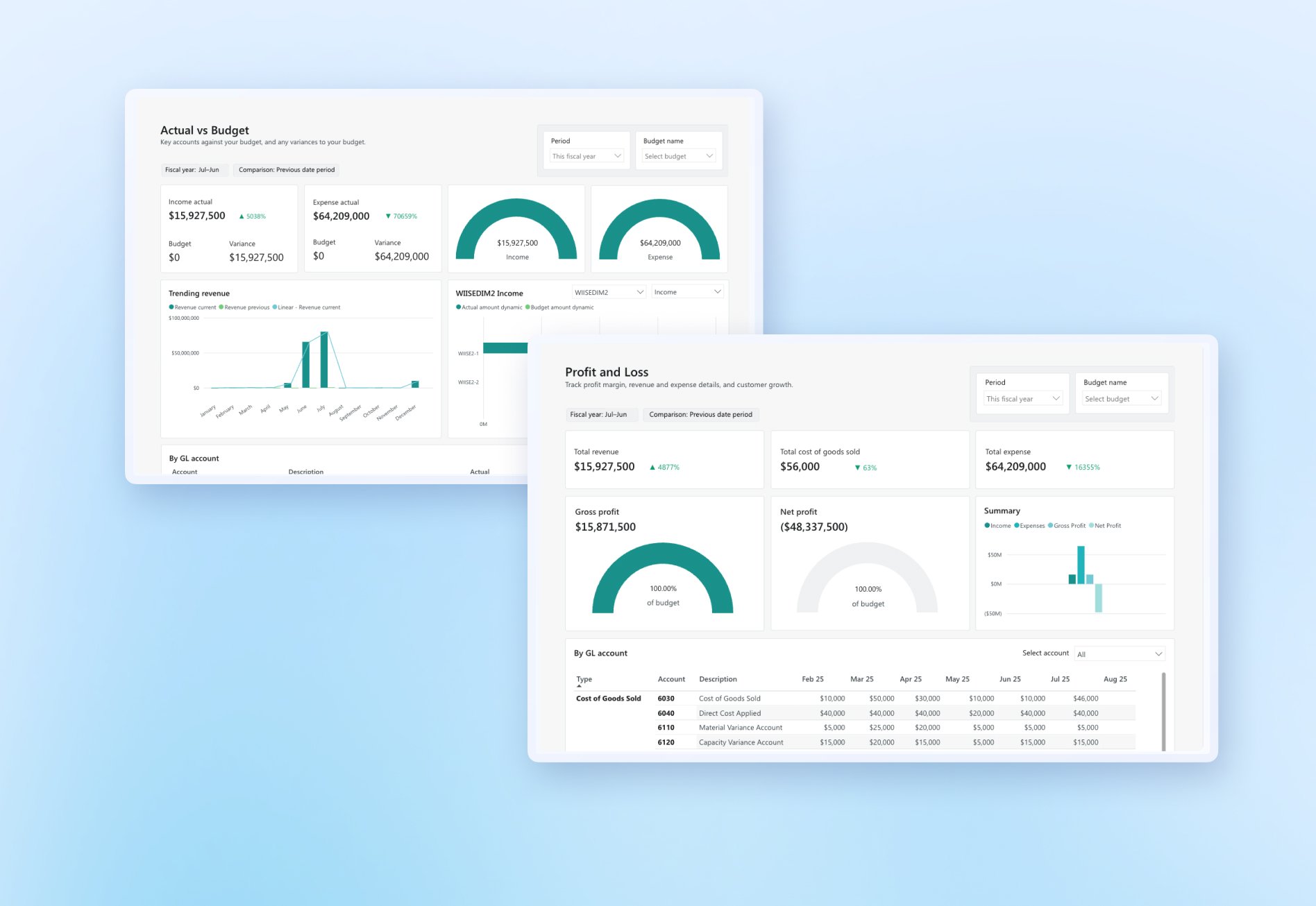

There is a range of actions that businesses can take to integrate business planning across functions, including investing in digital tools that enable data flow across various aspects of a business, in real-time. And, if it isn't already, this needs to become a key priority for organisations looking to accelerate their growth.

About the Wiise Value of Connection series

KPMG surveyed 1,300 finance and operations leaders from organisations in 16 countries across multiple sectors to quantify the impact of disconnected business functions. It published the findings in a June 2022 report titled Value of Connection, which you can download below. The report explains how deeper integration between Finance and Operations can transform customer experiences, build trust, and accelerate value creation.

With organisations in the APAC region making up 25% of this survey, the 2022 Value of Connection report has significant implications for business leaders in Australia.

Our four-part series unpacks the key takeaways from the report, which is a must-read for finance and operations leaders.

Other articles in the series

Love our content?

Our LinkedIn page has more great updates.