Financial management software has been around for a long time – so long, in fact, that we’re now seeing the limits of what the older systems can do.

Maybe you’re concerned about the security of the software housing all your data, your people are complaining about the outdated and clunky interface, or the sheer cost of updating an antiquated platform is causing stress for your CFO. For these reasons and more, businesses are increasingly upgrading their old financial management systems to cloud ERP (Enterprise Resource Planning) software.

In this blog, we’ll discuss the reasons why business owners should consider switching to more modern accounting and operational software.

1. Outdated technology

The first accounting software was launched in 1978. Over forty years later, some businesses use financial management software that is over 20 years old. While these platforms might have been occasionally updated over the years, this older technology may not be able to keep up with the demands of modern businesses.

Newer ERP software, on the other hand, is built on more modern technology and is better equipped to handle the needs of today’s businesses. For example, modern software usually has user-friendly mobile apps as standard, as well as the ability to easily integrate with other apps like eCommerce platforms or banking feeds.

2. Limited functionality

Older systems tend to focus primarily on financial management, and while they can include some added features like inventory management and CRM (Customer Relationship Management), these platforms are not as robust as other options available today. Business managers may find that they need to use multiple software applications to manage all aspects of their business, which can be time-consuming and costly.

3. Lack of cloud-based capabilities

Many older ERP and financial management software is not cloud-based, which means that they can only be accessed from a single computer or server. This limits the flexibility of the software and can make it difficult for team members to access information when they’re not in the office. During the pandemic, this meant that many businesses were limited to working on-site but this isn’t just limited to once-in-a-lifetime events.

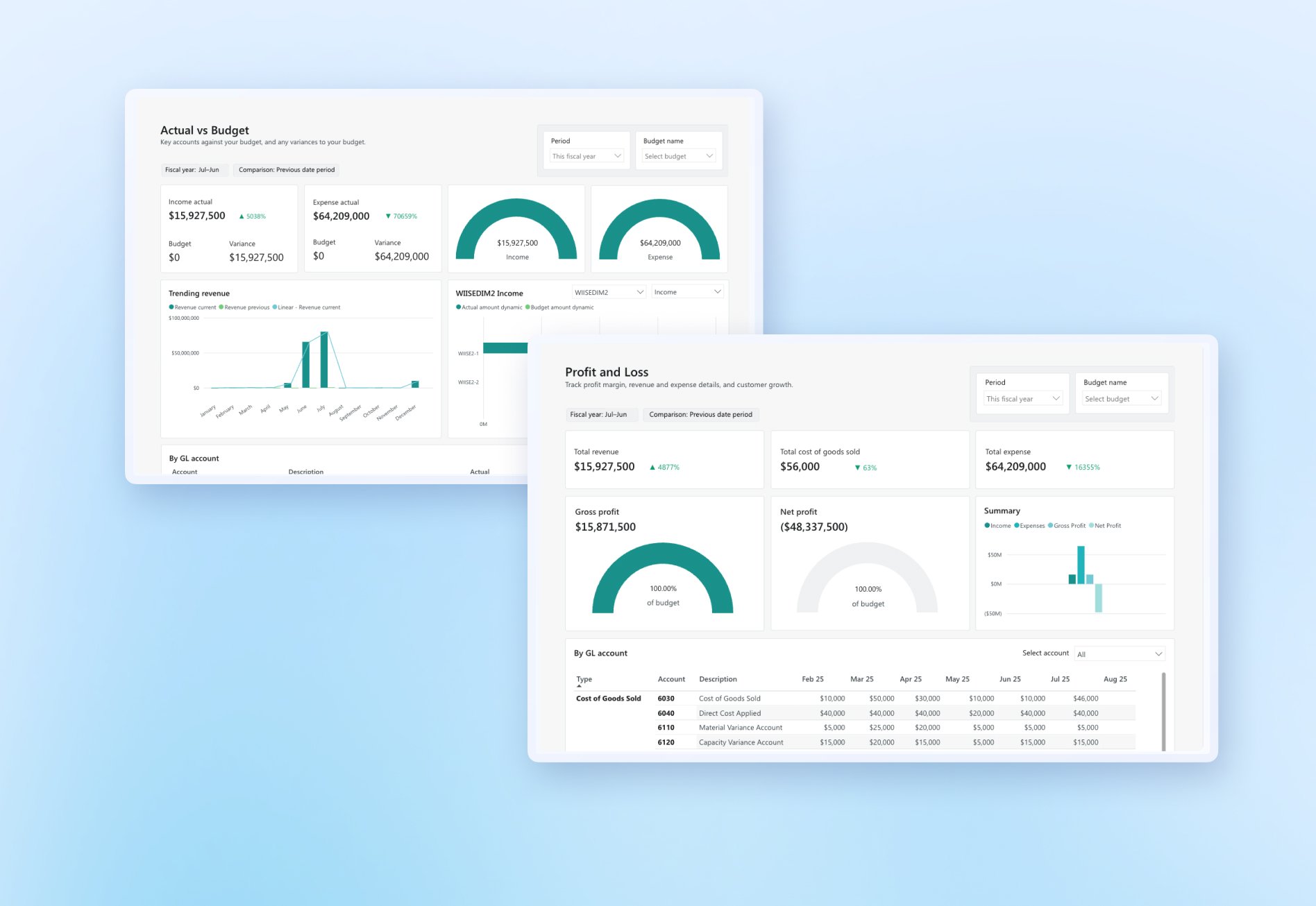

The way we work is changing, and our software has adapted to keep up. Cloud-based software like Wiise can be accessed from anywhere with an internet connection. Whether team members are in the office, in the warehouse, on the road or at home, they can access their business’s operating system and data.

4. Cost

While keeping your old on-premise software might seem cost-effective at first, it can be expensive for small to medium-sized businesses. The software requires not only a significant upfront investment, but also ongoing costs for maintenance and upgrades to ensure it still is secure and functional. Newer, cloud-based software options are generally more affordable and offer similar or even better functionality.

5. Security

In theory, on-premises software seems the most secure – it is literally housed in your offices. However, on-premises software is increasingly vulnerable to security threats, including ransomware. Older systems simply are not supported to the same standard as newer cloud software, and it shows – smaller businesses are increasingly reporting security threats where whole systems have been locked or held for ransom.

6. Data loss vulnerability

Many on-premise financial systems rely on backup solutions that are located on-site at the same physical location creating a single point of failure. These systems are often also untested and only found to be not working when a data loss event occurs. Modern cloud solutions can offer data redundancy across multiple physical locations and supply enterprise level up-to-the-minute backup to ensure your data never gets lost.

Looking to upgrade? Here’s what to look for …

When looking for a new platform, businesses should consider the following:

Mobile app capability: In today's fast-paced business world, it is essential to have access to financial and operational information on-the-go. Look for a platform that offers a mobile app, so you can manage your finances from anywhere.

Integration with other systems: Most modern software is built to integrate easily with other platforms and apps like point of sale, eCommerce, EDI and others. For example, in addition to these and many more apps on the Microsoft AppSource marketplace, Wiise can also seamlessly integrate with all the standard Office 365 apps you most likely use in your office: Excel, Word, Teams, SharePoint and many more.

Extended functionality: Job costing and inventory management are essential functions for many businesses to ensure that the full cost of goods or project work is being tracked. Look for a platform that offers these features and other more sophisticated functionality that can help your business grow.

Cloud-based access: Cloud-based platforms offer more flexibility and convenience, allowing you to access your business’s information from anywhere with an internet connection.

Affordability: While cost should not be the only consideration, it is important to find a platform that fits your budget. Look for a platform that offers competitive pricing and a range of pricing plans to suit your needs.

While in the short term, it might seem safer and cheaper to stick with what you know, in the long term there are hidden costs to consider. Business leaders should carefully evaluate their needs and consider switching to software that better fits their needs.

If you’d like to learn more about how Wiise could help your business, get in touch today.

Ready to learn more?

Book a demo call with one of our friendly team members.