The not-for-profit (NFP) sector is complex, and there’s a lot to think about. How can you get more funds and grants? Are you keeping your clients and sponsors happy? And the most time consuming… how can you run the right financial reports quickly and accurately? Not only that, you’ve got regulatory and compliance requirements to stick to. And you’re operating in a super competitive market.

The biggest worry for many NFPs? You rely on donations, funds and grants to continue providing services. But in an ever-changing landscape, those funds could easily dry up if the sponsor company goes bust or government regulations change.

Preparing for a better FY21 takes a little bit of reflection and a whole lot of action. And with the end-of-financial-year coming up, it’s the perfect time to do just that. So, how do you ensure you’re ready to stay in business and do things a little better? Let’s look at four key areas to see just how efficient your organisation is – and where you can improve.

1. Ask yourself if your team is spending more than 20% of their time on admin?

Managing your finances and accounts, and other business operations from multiple systems can mean a heavy admin load. And you probably have more than one person dealing with it full-time.

You might be using Excel spreadsheets which are hard to keep up to date as a team and even harder to keep track of. Then there’s the manual data input, consolidating spreadsheets, uploading and exporting. Getting invoices paid and keeping track of money owed can be time-consuming and leave you feeling like you’re never on top of everything.

Automated workflows and approvals can be a game-changer and give you back valuable time to focus on your clients and expand your services. But they can be expensive to set up, and you might not have the right skill set in-house to maintain them in the first place. So this all needs to be done manually too.

If you’d estimate that more than 20% of your finance and operations is manual admin, then it might be time to look at where you can make improvements. Bringing everything together in one system can save you both time and money.

Businesses that are looking to scale need to see exactly where their expenses are going. Tagging and tracking business expenses accurately across cost centres will give you detailed reporting just when you need it. Plus, a true reflection of your spend and profit and loss across the whole organisation.

2. Are you worried about compliance or audit risk?

Compliance is central to running an NFP, and it can be complicated and strict. Obligations must be understood and met, on time, every time. You’ll need to consider how you run grant acquittals and how you report to the regulatory boards. Then there are internal policies to adhere to, ATO and ACNC reporting, auditing controls and payroll quirks in the mix.

Audit time critical for not-for-profits. Without audit controls in place, it can be difficult to show that you’re doing what you’re supposed to be doing. If someone changes a transaction in the system, do you have audit trails set up, so you know who did what, and when?

Approvals are an important part of compliance, and appropriate delegated authority is essential. You’ll need to have workflow approvals set up that match your processes and show that you have the right eyes over your operations.

You may be hiring more full-time administration staff to manage your finance or operations. It’s a way of plugging a leaking hole, and many businesses think hiring more staff to manage finance and operations will help them grow. But it’s a short-term solution.

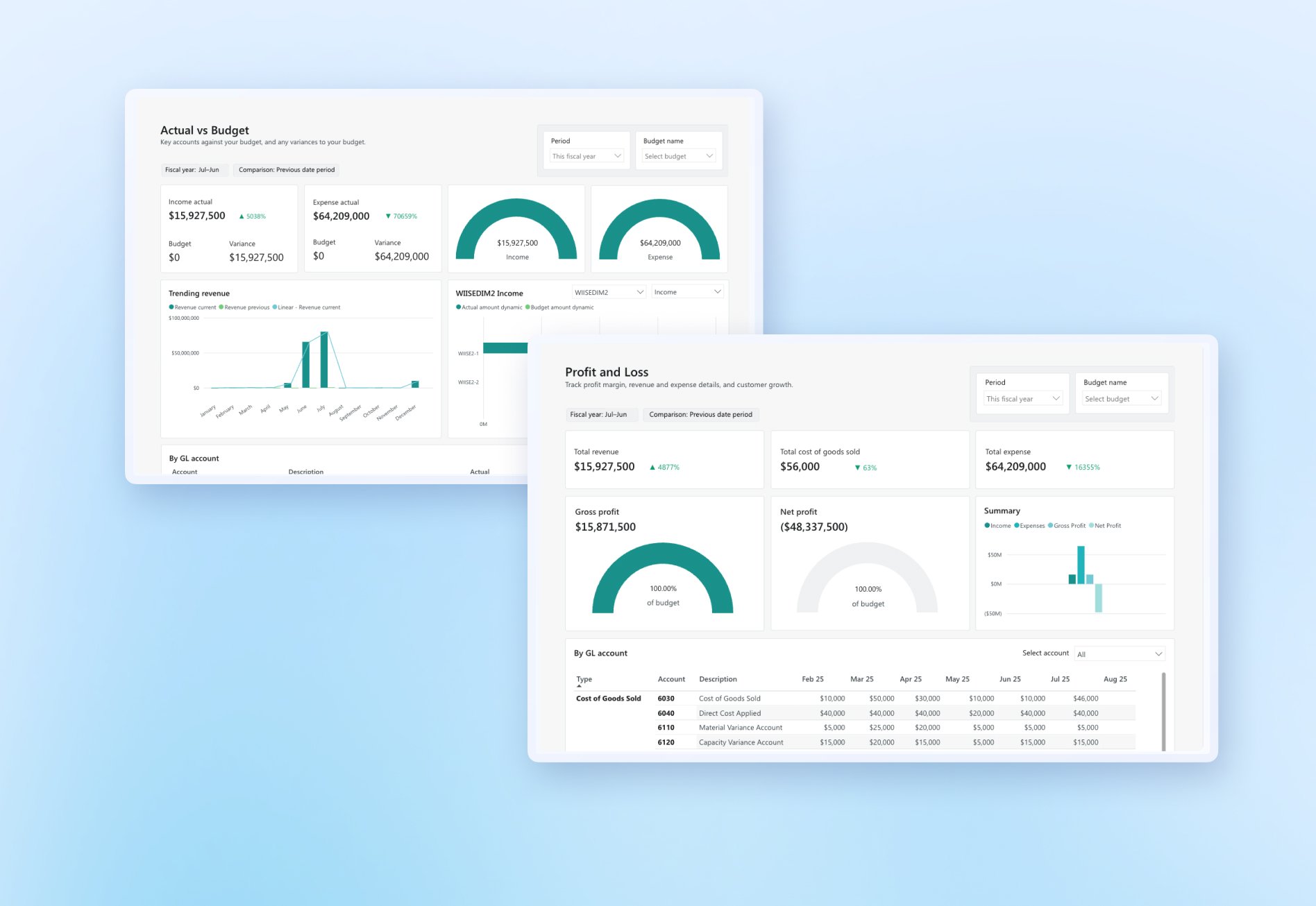

3. How long does it take for your team to produce financial reports for the business?

Is it taking your finance team days and days to produce financial reports for management and the Board? Does it take half a month? A week? That’s a huge impact on your productivity.

And all that time spent building and running reports is not spent analysing the data - and that’s where the value comes in - when you can put those insights back into the business.

What about the nitty-gritty? Getting granular information out of your system in real-time is the only way to really see the spending across the organisation accurately. This is about confidence in your financial data.

Client and supplier insights are important too. Do you have to log in to multiple systems to get clarity about your clients? Who are your top donors? Are you on top of overdue bills?

Real-time reporting that organises your data as it’s entered will mean you can stop wasting so much time organising everything in Excel and can ditch the data entry.

Flexibility is key for your employees. So think about how they access your current systems, and whether they allow you to grab data on the go, from any device.

4. Do you have visibility of where your funds and grants are going across your programs?

Sponsorships and grants are the lifeblood of every not-for-profit. So being able to keep track of them down to the detail is critical.

To do this, you need to be able to see exactly where you’re spending your funds and grants across multiple cost centres and project codes. This means you’ll need to have your purchase orders in the same system as your finances.

Knowing how much cash you have from sponsorship and grants and how you’re strategically managing your spending is the only way to stay competitive in the sector. And more importantly, to continue to attract funds in the future.

With the ability to tag, track and report on what you are doing as an organisation, you can get the clarity you need around your funds and expenses. So, review how you manage your expenses at the moment. If a sponsor or donor asked for a report, could you give them granular detail on exactly how you spent the funds?

By managing sales opportunities and driving engagement, you’ll see a big boost for your sales pipeline and forecasting. And understanding orders and revenue will help you make business decisions confidently. In such a competitive market, keeping your existing customers happy means your future customers will stay happy too. And in an ever-changing landscape, businesses can’t afford to lose too many customers. Customer service matters.

5. Square up to the challenge of running an NFP

Running a not-for-profit comes with some unique challenges. If you’ve reviewed your organisation and feel like it’s time to start looking for a new financial or operational system, then it’s time to start planning.

Check out our free NFP health check and discover where your financial and operational processes could be improved. Once you’ve identified the gaps, you’re already on the right track. You can also find out more about how Wiise can help NFPs manage their operations here.

If you'd like to talk to our team to see just how Wiise can help, get in touch here.