Two-thirds of business leaders around the world agree that increased visibility into their supply chains was key to maintaining operational stability. This is just one of many compelling findings in the new research by KPMG that brings together insights on global supply chains shared by industry leaders in Australia, UK, USA, and Singapore. What are the other major takeaways from this research for Australian businesses?

Over three articles, our new series on Supply Chain Resilience will unpack the themes discussed in KPMG's latest thought leadership to help Australian wholesale distributors and manufacturers reduce risks in the short term and maximise opportunities in the long run.

As global supply chains continue to be reshaped by environmental and geopolitical factors, Australian businesses should be doing everything they can to ensure that they don't get caught out when the next wave of disruptions hit. But what their preparation will look like, will depend largely on how supply chains evolve over the next few years. Our first article looks at the global factors that are likely to have an impact on supply chain over the next three years.

The 5 factors set to impact global supply chains over the next three years

1. Shifting geopolitics

Geopolitical tensions, be it in the Asia-Pacific region or in Europe, are proving to be a cause of worry for businesses relying on supply chains for two key reasons:

- concerns over essential materials becoming inaccessible

- fears major trade routes could be shut down

These concerns are shared particularly by businesses that are inventory-led or rely on supply chains to either manufacture or distribute goods.

As the push towards domestic self-sufficiency to address manufacturing and material supply concerns becomes stronger, governments and industry leaders are thinking beyond onshoring and near-shoring, and building trade links with like-minded countries instead.

‘Friendshoring’ is the growing trade practice where supply chain networks are focused on countries regarded as political and economic allies.

Rerouting of supply chains to countries perceived as politically and economically safe or low-risk are being seen as key to protecting against supply chain shocks in the context of a changing geopolitical landscape.

Did you know?

More than 6 out of 10 organisations around the globe expect geopolitical instability to have a detrimental impact on their supply chains in the next 3 years.

2. Component shortages: The 'second wave' of unplanned supply chain risks

KPMG's research also describes a second wave of unplanned supply chain risks that could be realised as early as this year with countries across the globe likely to experience limited access to:

- critical inputs for manufacturing

- spare parts

- critical maintenance items

Adding to the uncertainty is the fact that prices and availability of key commodities may also fluctuate. This includes fuel and diesel, construction items like timber, steel and resin, or plastic for packaging.

Navigating these pressures successfully will come down to an organisation's ability to adapt to changes quickly. This depends directly on building resilience along the entire supply chain.

Did you know?

71% of companies, globally, said that raw material costs would be the number one supply chain threat for 2023.

3. Increased focus on Cybersecurity

Trends show that cybercriminals are becoming increasingly sophisticated when it comes to infiltrating supply chains to steal from businesses or hold them to ransom as technology becomes more accessible.

The supply chains offer vulnerabilities that provide external parties with pathways to get into systems, particularly via the supplier network. Cybercriminals could also exploit vulnerabilities in basic warehouse equipment such as barcode readers or Internet of Things (IoT) devices that may be in use at manufacturing and other operational sites.

As a result, bolstering cybersecurity strategies, especially when rethinking supplier networks or when investing in new technologies, needs to be front and centre for businesses—not an afterthought—and will need to involve key stakeholder groups from across key business functions.

Did you know?

Almost half the global organisations surveyed by KPMG consider cyber security an important operational challenge for their supply chains through the next 3 years.

4. Impact of evolving retail and distribution channels

While getting goods into the hands of consumers in 2023 might appear easier compared to COVID-19 times, it will neither be simple nor inexpensive. Consumption mechanisms and channels continue to evolve and costs continue to rise, partially due to the manufacturing challenges explained above, but also due to the difficulty in getting goods into the hands of tech-savvy and discerning consumers.

Last-mile delivery challenges coupled with reliance on suppliers who may be experiencing difficulties themselves mean global and local retailers will need to review their inventory distribution network to create a seamless and unified commerce approach.

Overcoming this particular challenge requires a solution that can adapt to the unique needs of a business, whether that's improving upon your current warehousing capabilities with bespoke solutions or seeking out a new standalone 'plug and play' solution, it pays to be aware of the technologies available in market.

Did you know?

67% of organisations consider meeting customer expectations for speed of delivery as a critical force impacting the structure and flow of their supply chains over the next 12-18 months.

5. Uptick in supply chain technology investments

While digital transformation efforts often tend to focus on back-office processes and better customer engagement, using technologies to boost supply chain and operational capabilities will be front and centre in 2023.

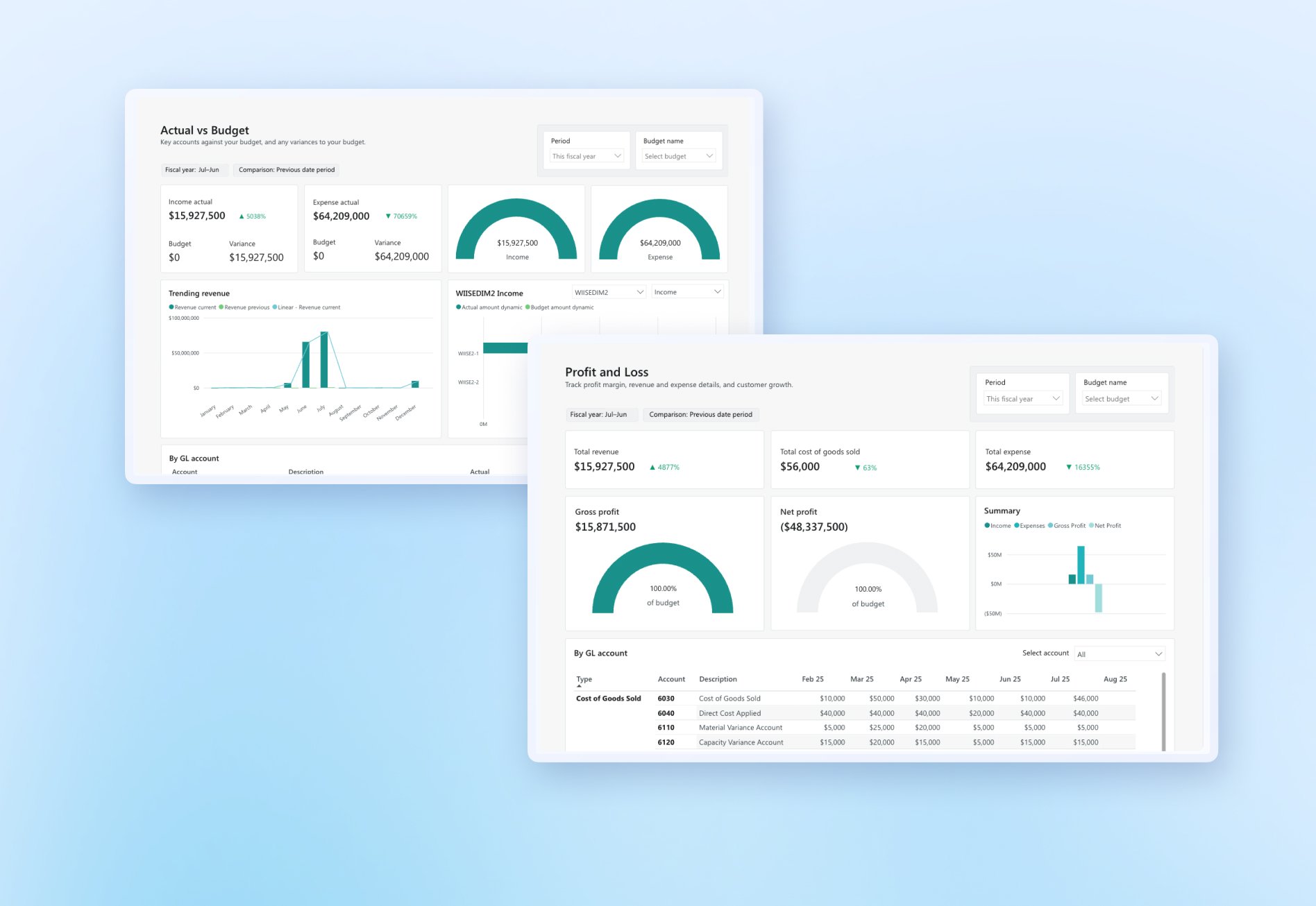

Businesses need to invest in increasing their supply chain planning maturity, automation of warehouse and operational tasks, and end-to-end supply chain analytics to get a direct line of sight into the details.

In response, major technology suppliers are developing holistic supply chain platforms. Rather than offering supply chain capabilities as discrete add-on systems, bringing them all together in one platform to provide a seamless user experience is the way forward.

Did you know?

6 in 10 organisations plan to invest in digital technologies to bolster their supply chain processes, data synthesis, and analysis capabilities.

Upcoming articles in this series

The writing is on the wall: Australian businesses need to take steps today to set themselves up for success in the long term.

The next article in our Supply chain Resilience series will recommend the actions businesses can take to prepare for and leverage the five trends discussed in this article to their advantage. Meanwhile, the final article in our series will look at how the supply chain planning capabilities offered by cloud ERP solutions can help you make your supply chain s three things: capable, flexible, agile, and traceable.

- Part 2: Preparing for the second wave of unplanned supply chain risks: Steps to take today

- Part 3: Boost your supply chain capabilities with an intelligent ERP system

*Source: KPMG’s global supply chains trends survey of November 2022.

^Source: Unchained Global Sourcing – charting the sourcing shift in Asia Pacific, December 2022.

Are you concerned about how the next wave of supply chains might impact your business?

Get in touch today to find out how you can be better prepared with Wiise ERP.

Ready to learn more?

Book a demo call with one of our friendly team members.