Update: Please note that this post is more than one year old and may contain information that has changed or been superseded.

There’s good news in the 2020-21 Budget for small and medium businesses. As part of the government’s JobMaker plan, the Treasurer Josh Frydenberg announced a temporary full expensing incentive to help businesses invest and recover from the coronavirus pandemic.

This $27 million budget spend expands the current instant asset write-off program, which has also been extended for six months. The aim is to support Aussies businesses and economic growth and to give a much-needed boost to our economy, hit hard by COVID-19.

“A trucking company will be able to upgrade its fleet, a farmer will be able to purchase a new harvester, and a food manufacturing business will be able to expand its production line,” announced Treasurer Josh Frydenberg.

What does this mean for your business?

To encourage businesses to spend now, you’ll be able to immediately deduct the total cost of new, eligible depreciating assets that are held, used or installed between 6 October 2020 and 30 June 2022. So, you’ll reduce the tax you pay right away. For small and medium-sized businesses, this applies to second-hand assets too.

You can also deduct the full cost of any improvements made to depreciating assets during the same time, even if those assets where bought before the 2020 Budget announcement.

Assets used or installed by small or medium businesses by 30 June 2021 will also qualify for the instant asset write off, a welcome extension of six months.

Small businesses with an aggregated turnover of less than $10 million can also deduct the balance of their ‘simplified depreciation pool’ at the end of the income year during the time that full expensing applies. The rule that prevented small businesses from re-entering the ‘simplified depreciation regime’ for five years if they opt out will stay on hold.

Who’s eligible

Fortunately, the incentives are far reaching. The new asset write-off measures are available to Australian businesses with up to $5 billion in annual turnover. This covers 99% of businesses.

Small and medium businesses that earn between $50 million to $500 million can fully expense assets up to $150,000. So, if you’re thinking about buying new equipment for your warehouse or adding another truck to the fleet, now’s the time.

When can you get started?

The scheme starts from the time the Budget was delivered—7.30 pm, 6 October 2020, until 30 June 2022.

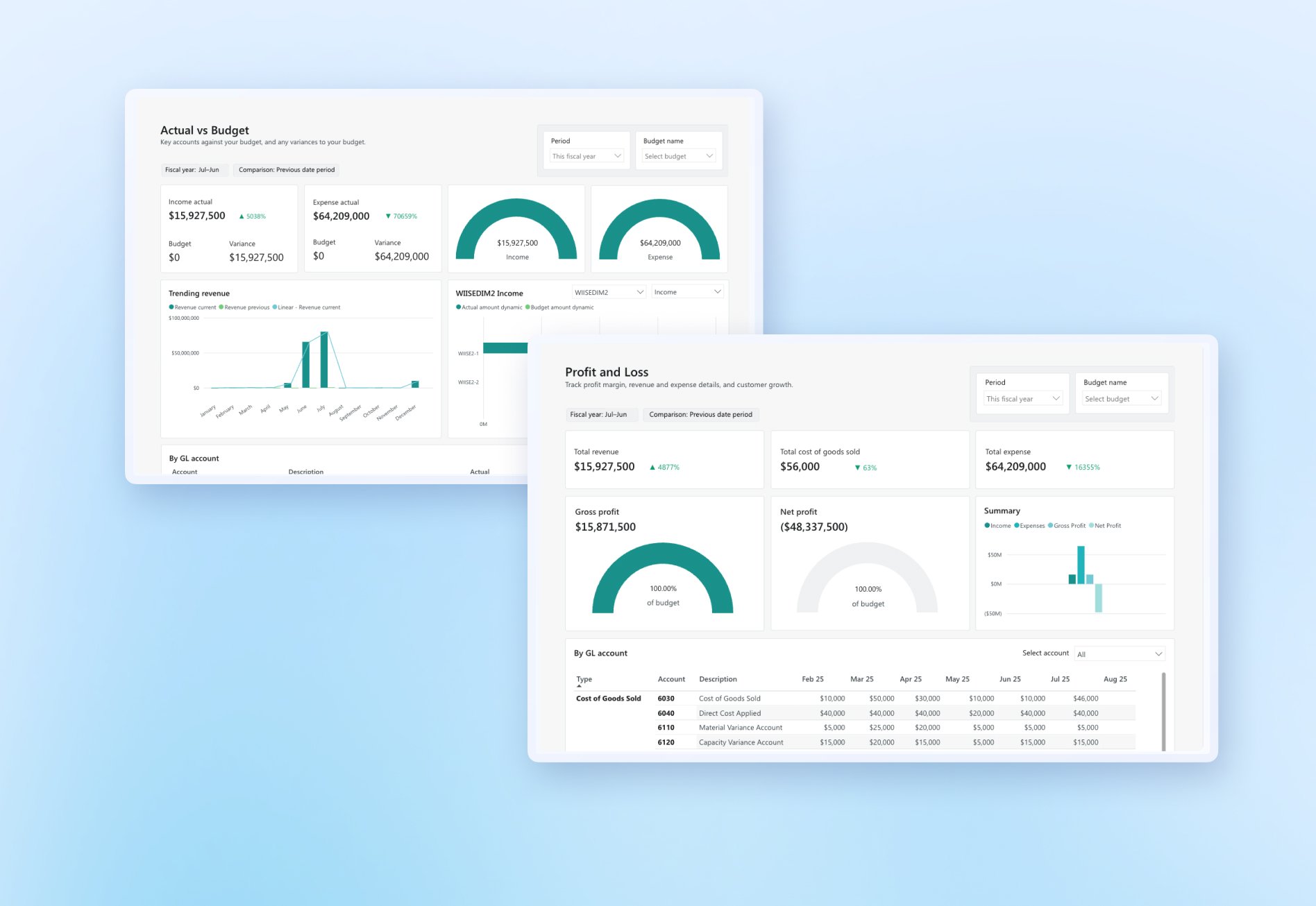

More support for businesses to go digital

On top of the instant asset write off incentive, the government’s JobMaker Digital Business Plan is helping businesses adopt new technology to recover their operations and create more jobs. Check out our blog Support for businesses adopting tech to lead recovery for more details.

For more about the JobMaker plan, head over to the ATO website. And if we can help, we’d love to hear from you. Reach out anytime at hello@wiise.com.