What is Single Touch Payroll and do I actually need it?

In July 2018, the ATO introduced Single Touch Payroll (STP) to streamline business reporting for salaries and wages, PAYG withholding, and super information. In the past, the ATO only required this information to be reported annually, but with the introduction of STP, all businesses will now be required to report these payments every time they pay their employees or run payroll.

So what does this mean?

This year on 1 July 2019, it will be mandatory for all small businesses with 19 or fewer employees to be STP compliant. This means if you’re currently using an excel spreadsheet or even paper to process your payroll, you may need to switch to a digital payroll provider (that’s STP supported) before July 1. Single Touch Payroll may seem scary, but it’s really just a way to streamline your reporting processes and make life easier in the long run.

How do I become STP compliant?

If you’re ahead of the game and already using a digital payroll provider, it’s important to check if the system you’re using offers STP reporting. If not, you will need to look for another provider.

If you don’t have a system in place, you will need to look for a payroll provider who is also STP compliant. Moving to a digital payroll provider will not only save you hours of time but also make sure you avoid any run-ins with the ATO.

Can Wiise make my life easier?

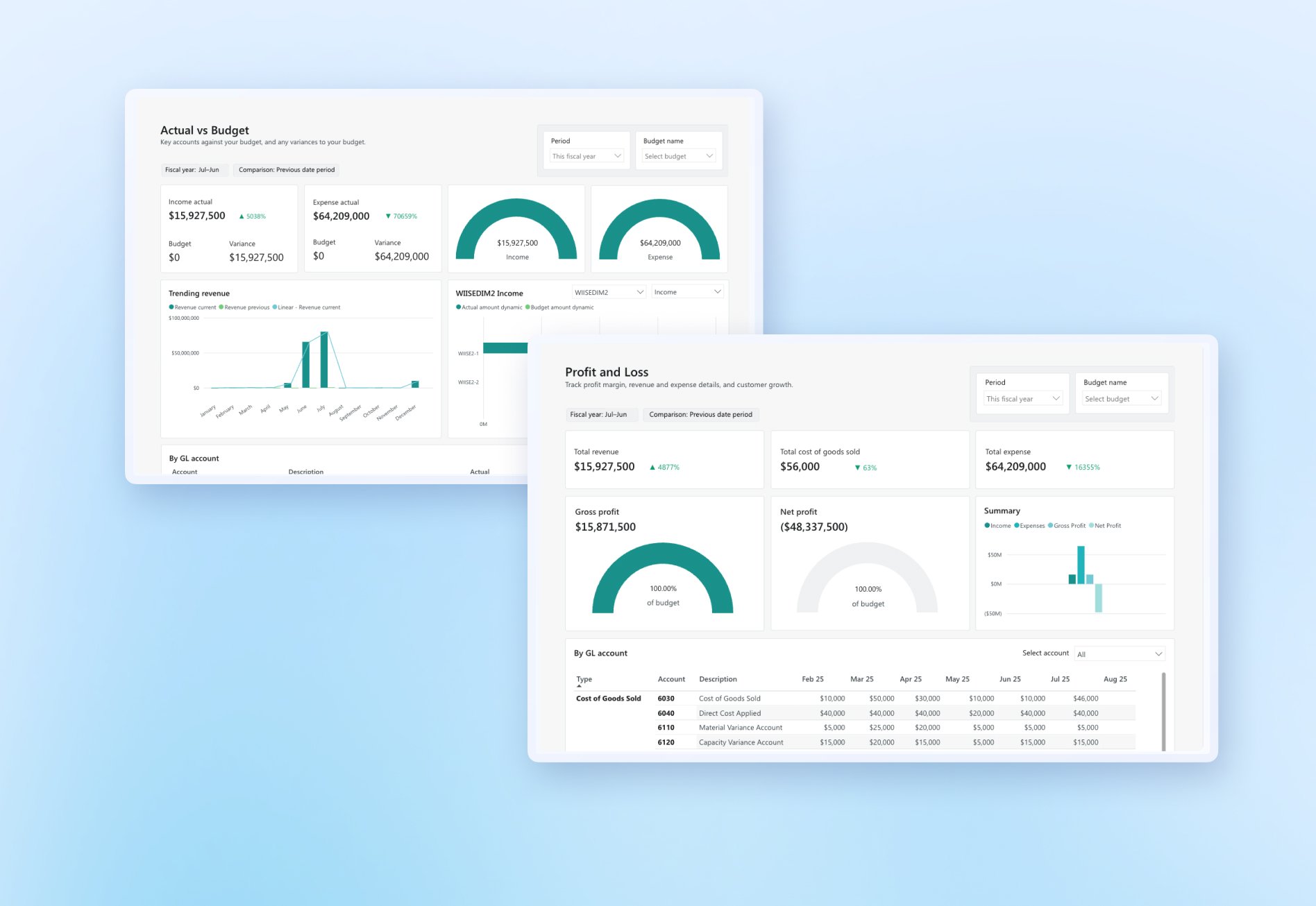

Wiise is more than just cloud accounting. It’s clever business software that brings your accounting, operations, banking and payroll all together in one hub. This saves you logging in and out of siloed systems, speeds up processes and streamlines operations, giving you greater visibility of your business. Wiise gives you the complete picture with all your information at your fingertips.

More importantly, Wiise Payroll is fully STP compliant and provides you with auto reporting, fast processes and cloud security to ensure that you not only comply with the ATO, but also save time and effort.

So, what’s the benefit for me and my business?

- Manual processes such as payroll journals are eliminated

Rather than having to configure the journal service in Payroll, journals are automatically posted once the pay run is complete. - Employee records are streamlined

Your employee records will be automatically synced with Wise and you can access the extra functionalities of Wiise HR. - The complexity of modifying your chart of accounts in Payroll is taken away

Instead of having to maintain two separate chart of accounts (COA) in both Wiise and a separate chart of accounts in Payroll, Wiise links the pays with your COA using a chart of accounts sync function. - Clarity on employee costs along with powerful tagging, tracking and reporting capabilities

STP reports also keep records of wages paid, taxes deducted and super contributed.

We’ve built STP in Wiise Payroll to be as simple and efficient to use as possible, but why not check it out for yourself?

Learn more

To find out more about Wiise Payroll and how we can help your business, watch our introduction to Payroll video.

Looking to chat with a Wiise expert? Request a call back today.