Staying on top of your cash flow can mean the difference between growing your business and finding yourself out of operation. Today, nearly 60% of small and medium businesses only have enough cash to support themselves for 6 months. And even large enterprises can run into cash flow problems. That's a frightening thought, especially in the middle of a pandemic that's affecting businesses in many industries with reduced sales and uncertainty.

So how can you stay on top of your cash flow effectively? What can you do to make sure your business has enough cash in the bank in 6 months' time? It's time to plan for the future before you run into trouble. Here are six practical things you can do now to keep your cash flow worries in check.

1. Monitor your cash flow in detail

It might seem obvious, but the first thing you need to do is get a clear picture of your cash flow. Know the detail of what money's going out and what's coming in so you can make plans based on good info and develop your roadmap.

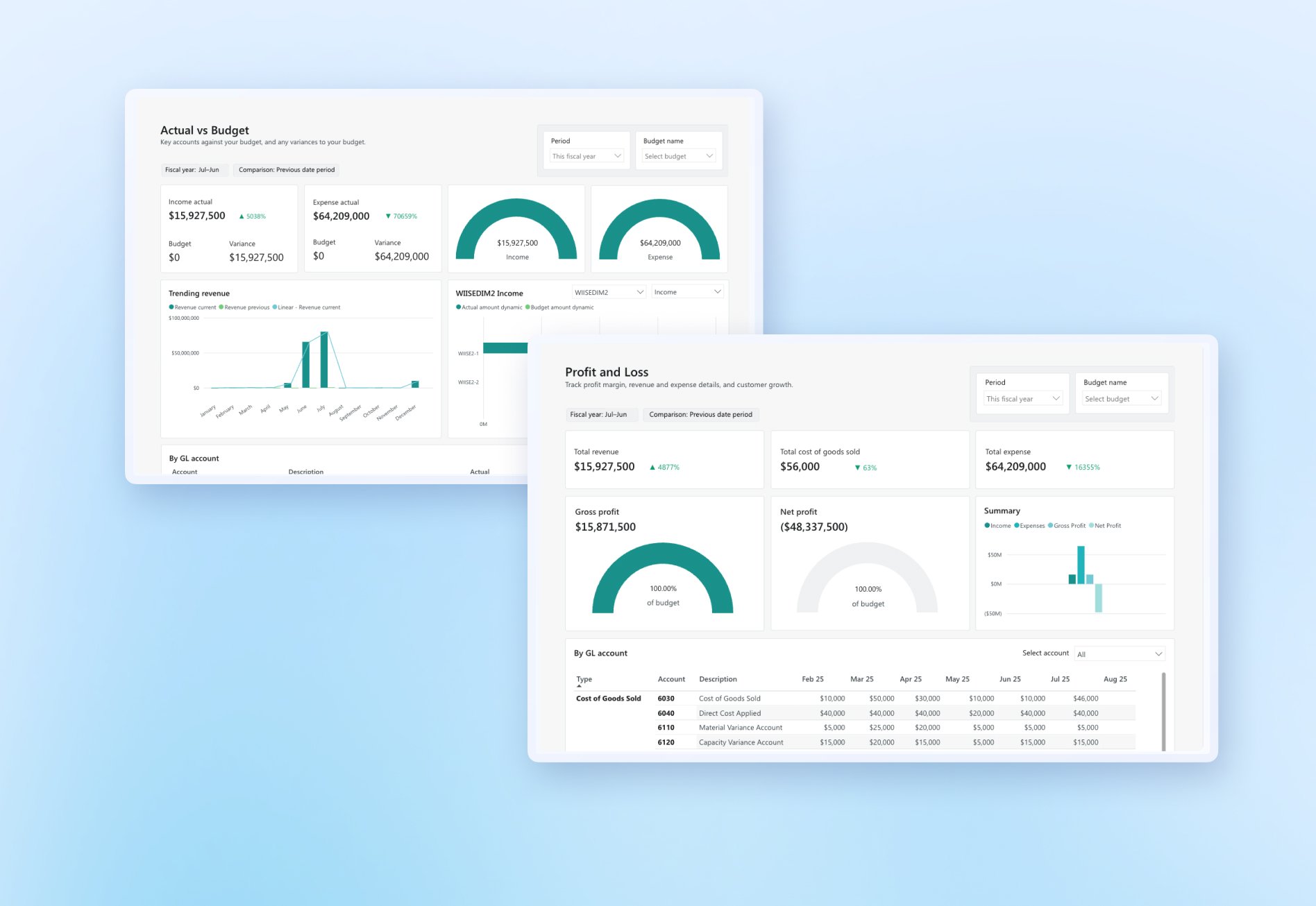

Good accounting software will help you do this. If you can get a tool that lets you see your cash flow in real-time, all the better for making decisions quickly and confidently. See when people are paying you and if they're paying late, look at trends, see your cash flow position up to the minute and plan appropriately. And give everyone in the business a single source of truth to rely on.

Once you know the facts about your cash flow, you can build cash reserves, adapt your plans and tweak them as you go.

2. Make cash flow your number 1 priority

Making a profit may seem like the most sensible thing to focus on — when things are going well, why not? But for businesses affected by the pandemic, cash management needs to be your top priority. And that strategy needs to from to the board down, across all your departments.

Make sure all your teams, from finance to sales, are looking at the same numbers and are on the same page. Working together strategically to bring money in and look at ways to reduce the flow out is essential. You may go through a period of reduced or no profit, but don't lose focus on what's important — to stay in business.

3. Cut back on your expenses

Look at your regular outgoings — how, what and when you spend. If you won't be able to make your payments for the next month or quarter, or money coming in is slowing down, you need to find ways to cut costs immediately.

Reducing your spend can help your cash flow, and there can be some quick wins here. Take the opportunity to renegotiate supplier contracts or see if you can organise a credit extension. Look at cutting your office supplies and utility costs.

Do an audit on business system licences and company mobile phones and see where you can trim down. Even office equipment and assets that you no longer need could be sold. Every little bit can help.

Speak to your bank if you need to secure additional funding or arrange repayment plans. And give yourself plenty of time. Maybe your crisis point won't come for a few months, but it's better to be proactive and prepared and avoid a crisis.

4. Look at your sales trends

If you're experiencing a sales downturn due to COVID-19, you need to understand what this is doing to your cash flow month to month. You could potentially experience loss for a while, but if you run out of cash, it's almost impossible to come back. Perhaps it's time to reach out to new markets or adapt the way you serve your existing customers. Many businesses have built online sales channels to reach customers who aren't getting out and about as much. And get smart with your social media — with more people working from home, you've got a captive audience to connect with.

On the flip side, your product or service may be exactly what customers are looking for now, so business may be booming. If your demand has increased, you need to factor in added cash, but you should still be mindful of your cash position. More demand means you might need to bring in more inventory and manage associated cost increases.

Whether your sales are going up or down, your focus needs to be understanding your cash flow so you can keep operating.

5. Get paid faster

It's time to get proactive about getting cash in. Take a look at your payment terms and reach out to your customers to chase debt or late payments if that's appropriate. But be practical. Those businesses are probably being mindful of their payables too. Can you offer any discounts? Or organise a payment plan?

If you want to make it super easy for customers to pay you, think about adding a one-click payment button to your invoices and get money in your bank faster.

If you're a wholesale business, take a good look at your inventory and consider having a fire sale to offload excess stock and give your cash flow a lift.

6. Get help

You need to be looking at your cash flow forecasts now. As well as inventory forecasts, impacts on funding and your overall financial stability. But accounting is a skill that we're not all blessed with! So consider hiring an accountant to help you take control of your finances and keep an eye on your cash flow. That way, you can focus on the things that keep the money coming in and stay in business.

7. Get a boost to your cash flow

The Government is providing up to $100,000 to eligible small and medium-sized businesses and not-for-profits (NFPs) to help them through the COVID-19 crisis. This includes a minimum payment of $20,000 to you help pay wages or to invest in protection against a downturn. These payments will help you with cash flow so you can keep operating, keep staff on and pay your rent and other bills. Check out the ATO website for more details.

Times are tough for Aussie businesses, but we're all this together. If there's anything we can help with, please reach out to the team at hello@wiise.com.

The Wiise Team