On December 1, 2025, New Zealand’s first regulations to support the uptake of open banking took effect, requiring the country’s four big banks to allow secure sharing of financial data with accredited third parties.

While consumer banking leads the way, compliance requirements for business banking will follow beginning June 1, 2026. For SMBs, open banking opens the door to simplified financial processes, better cash flow visibility, and easier innovation.

Keep in mind, you won’t notice any changes within Wiise at this stage. Our existing bank feed solution for New Zealand will continue to operate as normal for the time being. However, we’re working closely with our technology partners at ACSISS – the leading provider of open banking technology in Australia – and will keep you updated when their forthcoming NZ open banking solution becomes available in the Wiise platform.

Regarding the shift, SISS Data Services Founder and CEO Grant Augustin said, "We're looking forward to extending our partnership with Wiise to cover New Zealand Open Banking services. We expect to be providing our accounting-grade bank transaction data to simplify reconciliations and cashflow management for Kiwi businesses mid-year 2026."

A giant leap towards modernisation

On December 1, regulated open banking officially went live in New Zealand. While it is a significant technical upgrade, it also represents a fundamental shift in how financial data moves between banks, businesses, and third-party providers.

Under the Customer and Product Data Act 2025, New Zealand’s big four banks — ANZ, ASB, BNZ, and Westpac — are now required to offer secure APIs that allow customers to share their financial data safely and instantly. Kiwibank and other financial institutions are required follow by June 1, 2026.

Each of these banks will also be required to begin offering APIs for business banking transactions by the June 1, 2026 deadline.

What does this mean for SMBs?

For small and medium businesses, open banking provides some real, tangible benefits:

- Simplified payments + approvals

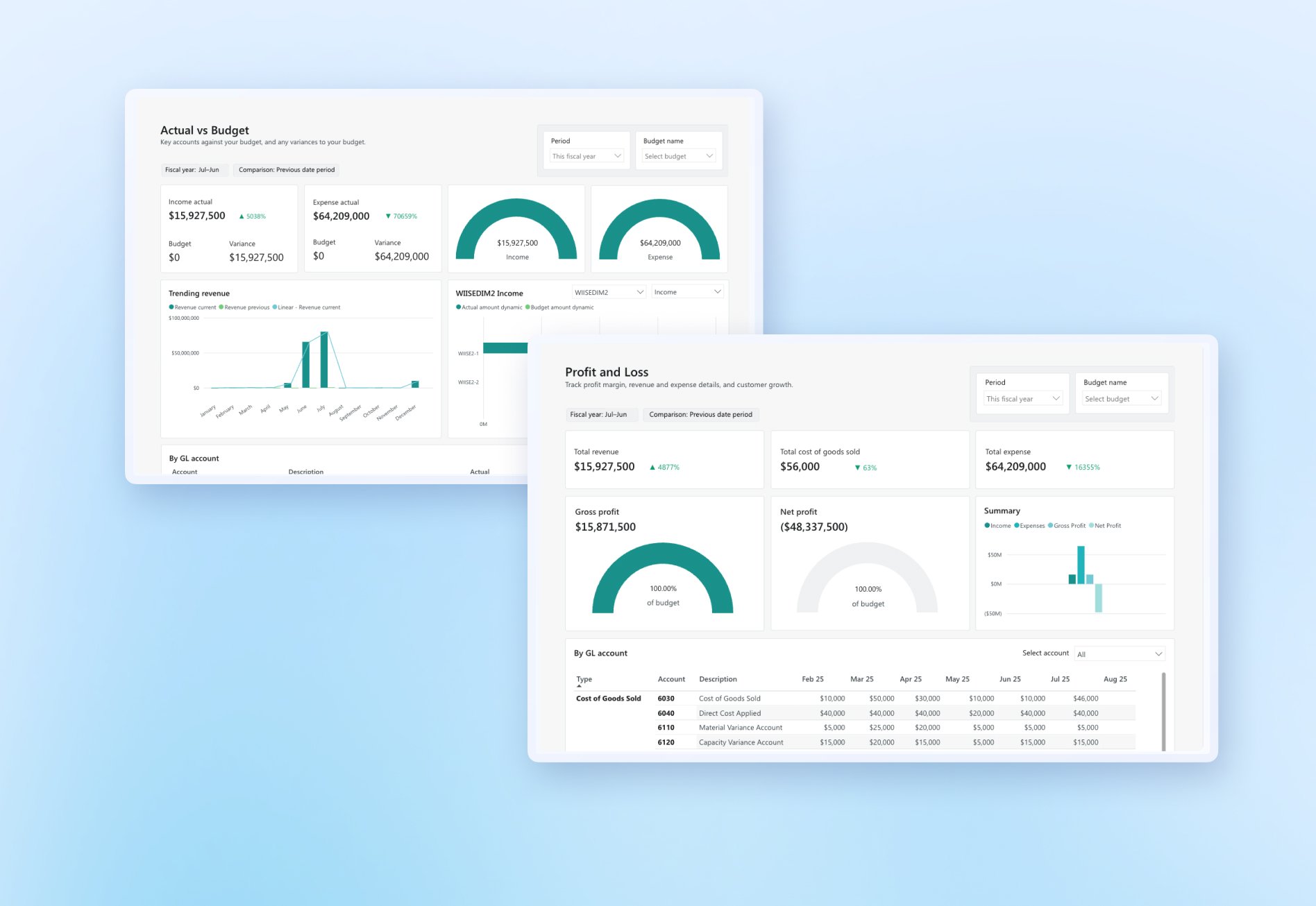

Initiating payments directly from your accounting/ERP system is easier than ever, since financial data can be accessed instantly.

- Better cash flow visibility

Real-time access to bank balances and transactions means fewer surprises and delays, paving the way for more informed decisions.

- Smarter financial tools

Kiwis will likely see an onslaught of new apps offering personalised budgeting, automated reconciliation, and cost-saving insights, all powered by secure, standardised data.

- Easier bank switching

Open banking makes it simple to share your financial history with a new provider, reducing friction and encouraging competition.

- Unified support for all account types

Open banking isn’t limited to transaction accounts – users can also instantly share data related to other financial products like business credit cards or loans too.

The timeline

- December 1, 2025: Consumer accounts go live for the big four banks.

- June 1, 2026: Business banking accounts and payments compliance kicks in.

- December 2026: Full rollout for all other services.

For SMBs, the real impact will start in mid-2026 when business accounts are included. That’s when tools for automated bank feeds, payment initiation, and integrated financial insights will become widely available.

Why these changes matter:

Until now, many businesses relied on outdated methods like screen scraping to sync bank data with accounting systems, a workaround that breaks when MFA is used and poses real security risks.

Open banking replaces that with regulated, API-driven connections that are:

- Secure (customer consent is mandatory)

- Reliable (no more broken feeds)

- Future-proof (aligned with global standards)

What should businesses do now?

- Stay informed: Ask your bank when their open banking services for business accounts will be ready.

- Talk to your software provider: Ensure your accounting or ERP system plans to support open banking feeds.

- Plan for adoption: The sooner you switch, the sooner you benefit from faster payments and better financial visibility.

The bottom line

Open banking is a major step into the future that will continuously pay dividends to Kiwis and their businesses, giving them more control, less friction, and smarter financial management.

Regarding the changes,

Let the countdown to June 2026 begin!