Behind every high-performing organisation is a high performing finance team – and a CFO with vision. To get to the heart of the challenges facing today’s SMBs and their finance teams, we’re going straight to the source and asking the CFO. Welcome to the Wiise CFO Spotlight series.

CFO Spotlight

For our first spotlight post, we’re speaking with Cameron Rollason, CFO at fire protection company, FVS. FVS is a fire protection company, in business for more than 30 years. The FVS Group was purchased by Pamoja Capital in July 2019. The FVS Group has grown significantly since the acquisition and more growth is expected in the next 3 to 5 years.

Q1: Tell us a bit about your role at FVS

I am a Chartered Accountant who has previously held numerous Senior Finance roles, starting my career as an external auditor. I joined the FVS Group in 2019 as a consultant and was subsequently offered and accepted the role of CFO in Feb 2020 I was tasked with bringing FVS’s business and finance processes into line – making them more compliant, more efficient and set up to facilitate rapid growth.

Q2: What were you hoping to achieve, as CFO?

The finance team should be integral to the business. I want us to be contemporaneous in our reporting, with a forward-looking approach, so we can provide an early warning to the rest of the business of potential roadblocks and obstacles to be navigated. Finance should be complementing the entire business – helping sales to sell more and senior management to make better decisions.

Q3: Why did you decide to switch to a new ERP?

Compliance was one part of it – but another big consideration was the ability to cut and dice information to achieve full visibility of the business and its divisions. Our previous finance system had its place – but the business had outgrown the offerings of the previous finance system some time ago. We now have a turnover of $50 million and 250 staff – that requires a heavy hitting payroll system and the ability to analyse information in many different ways.

"We now have a turnover of $50 million and 250 staff – that requires a heavy hitting payroll system and the ability to analyse information in many different ways.”

Cameron Rollason, FVS

Q4: How did you discover Wiise?

Our auditors are KPMG and our audit partner, Jeff Fraser, introduced our CEO to Wiise. We had considered a few other options but chose Wiise, which was well equipped to handle our finance system needs and offered the most competitive price point.

We also wanted something that allowed easy integrations. I’ve seen many systems that work and many systems that don't work. The idea is that you take all the best features and implement those as you go to make the finance team relevant and customer service focused.

"We also wanted something that allowed easy integrations."

Cameron Rollason, FVS

Q5: What difference has Wiise made to FVS?

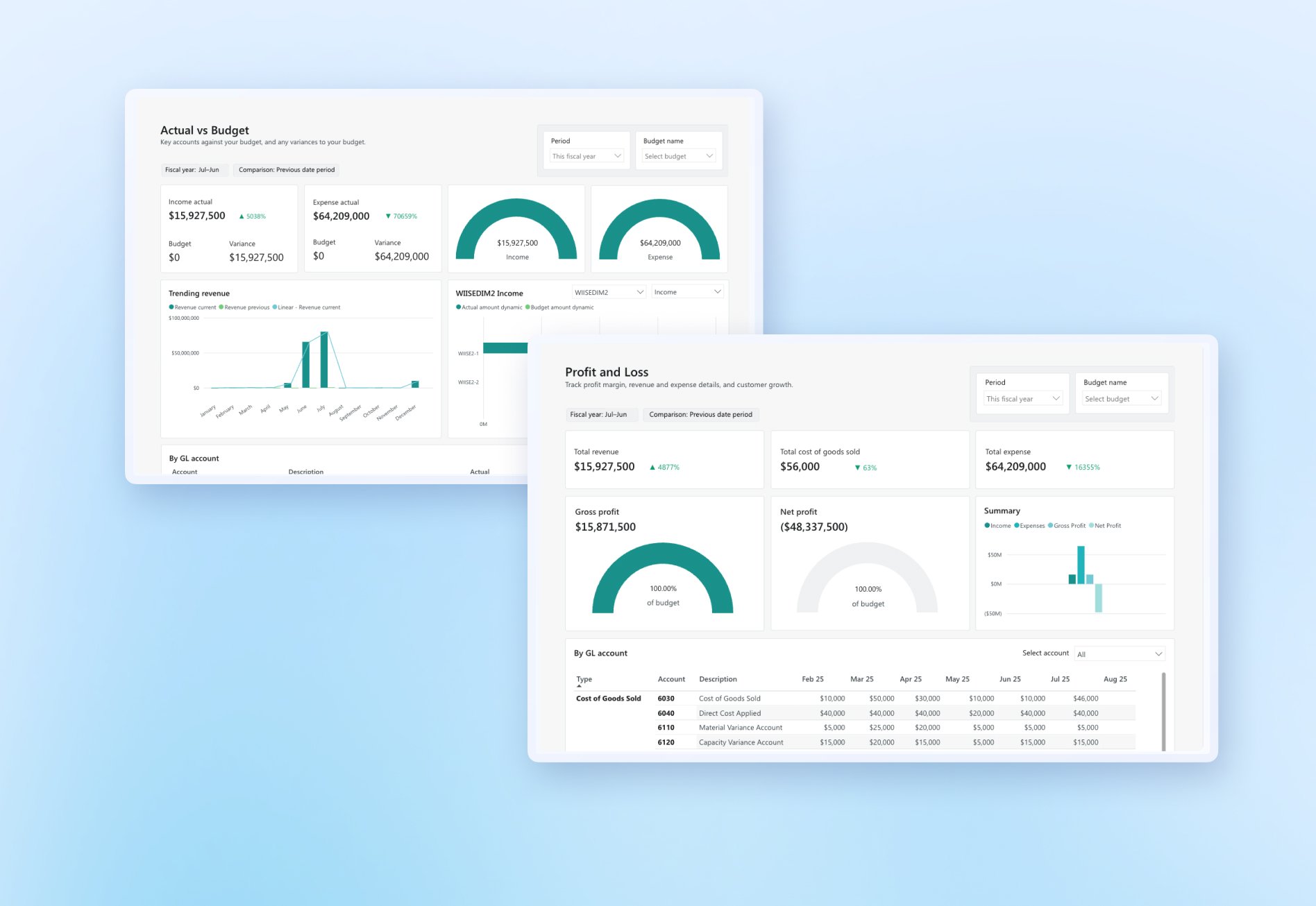

We have recently rolled out Microsoft Power BI reporting through our business portals to supervisors, managers and senior management. These personnel now have self-service access to our accounting system and information they couldn’t have even dreamed of with the old system. It’s revolutionary.

The real difference for us comes with the suite of dimensions in which we can now view and access information – Power BI combined with the Wiise reporting has really brought that out. Previously, we were creating spreadsheet, after spreadsheet to get information to the teams that needed the information – because there was no other way. Complementing Wiise with Power BI has enabled us to share highly accurate reporting, at speed – and sliced down into ways that is exactly relevant to the needs of the user. None of that would be possible without Wiise.

"Complementing Wiise with Power BI has enabled us to share highly accurate reporting, at speed – and sliced down into ways that is exactly relevant to what they need. None of that would be possible without Wiise."

Cameron Rollason, FVS

Q6: What other tools will you integrate with Wiise?

To improve the routing of vendor invoices, we’ve implemented a system called ExFlow. This application integrates directly with Wiise to manage the routing and approval process of accounts payable invoices – and it’s going to revolutionise the way we look at invoices. Wiise is enabling us to take advantage of these excellent systems because it integrates so easily with them. By integrating ExFlow to Wiise, we’ll have very quick invoice approval, review, costing and rejection, enabling us to process invoices through the system faster. That’s been one of our biggest challenges to date with the business rules and how they control the routing of vendor invoices.

The other software program which compliments ExFlow is Kofax – an OCR system that allows the population of invoice data directly into the ExFlow system, without the need for manual input. The ExFlow and Kofax vendor invoice processing solution provides greater visibility and maintenance of our rules of delegation.

Wiise utilises the KeyPay payroll system, which was also a big draw card for us. KeyPay is excellent at handling sophisticated payroll tasks, such as enterprise bargaining agreements (EBAs) and difficult awards – but the fact that it then directly connects to Wiise is just the perfect combination. It means we can set up processing rules in KeyPay which are then automatically posted straight to Wiise. It has removed all the paper from our payroll processes. Previously we had paper timesheets but, Wiise also uses a timesheet mobile app called Workzone, so all hours can be logged by the technicians, sent straight to KeyPay and then onto Wiise for reporting.

Wiise is enabling us to take advantage of these amazing systems because it integrates so easily with them.

"Wiise is enabling us to take advantage of these amazing systems because it integrates so easily with them."

Cameron Rollason, FVS

Q7: Can you give us any examples of where Wiise has made a measurable improvement to the business?

Yes, definitely. Payroll has been a huge transformation for us. Logged work hours, leave applications, starting new personnel, hiring, letters of offer – all of that is now recorded and stored online. To put it into context, I’d estimate a 25% reduction in the number of people required to process payroll.

For our technicians, once we switched to the new system, they very quickly preferred it because they can now enter their worked hours on their phones, whereas previously they’d need to find a desk and enter it into an excel spreadsheet, then email that to finance.

Generating our profit and loss reports is also an entirely different experience with Wiise. We run multiple branches through one company, but previously we had no way of showing, for example, our Perth manager his outstanding invoices and debtors. With Power BI and Wiise, we now have charts that are constructed in slices – for example, location, division, department, work type etc. This gives us a powerful drill-through capability, meaning you can interrogate data down to branch level.

Being able to share information about outstanding debtor balances enables our branches to stay on top of debts, maximises our bank balances, reduces time spent chasing – and significantly improves the customer experience.

It’s also brought additional reporting time savings – we’ve cut five days a month off our board reporting process.

"It’s also brought additional reporting time savings – we’ve cut five days a month off our board reporting process."

Cameron Rollason, FVS

Q8: What are your future plans for Wiise?

We will have the ability to connect data from FireMate with KeyPay. FireMate records the time a technician has worked on a particular job – so we’re planning to use this to gain visibility on how many hours a technician has worked measured against how many hours they’ve been paid. This has huge potential for improving our staff utilisation and spotting opportunities for efficiency.

Wiise has given us the visibility to spot and fix problems on the fly, instead of only at month-end. That has far-reaching benefits, but even on a day-to-day level, it means we can pass payment issues onto account managers sooner, which increases the rate of collection. At the moment our debtor days are running at 50 days – I want to bring that down to 45 days. We will achieve that using the Power BI reporting, by engaging the rest of the business to assist the finance team through the provision of current data.

Wiise has been a significant investment in the future growth for the FVS Group. Without it, we wouldn’t have been able to grow – or continue to grow. It’s transformed the business and there are still a lot of capabilities that we haven't utilized yet – but we're going to.

"Wiise has been a significant investment in future growth for FVS. Without it, we wouldn’t have been able to grow – or continue to grow. It’s transformed the business and there are still a lot of capabilities that we haven't utilised yet – but we're going to."

Cameron Rollason, FVS

Find out more about how Wiise ERP has helped FVS to transform its finance department; read the full case study here.

Ready to learn more?

Book a demo call with one of our friendly team members.